If you’ve ever watched any of the house flipping series on TV, then you might assume that to make money house flipping , you need to do little more than fall off a log. It looks so simple! At the end of every episode, they show you a quick accounting of their efforts. It goes something like this – to make money house flipping :

1) Buy the house for $250,000.

2) Renovation expenses $60,000.

3) Sell the house for $385,000. They make $75,000. Simple.

And if you are an avid viewer of any of those shows you soon see that they make money house flipping every week! If that is true, then “there’s gold in them thar hills!” But the devil is in the details. Before you go and quit your job and head out to strike it rich in the flipping gold fields, take a little longer look at the math.

The truth is that Realtytrac.com reports that there was an “average $58,250 gross flipping profit in Q1 2016…. ” http://www.realtytrac.com/news/real-estate-investing/q1-2016-u-s-home-flipping-report/ . Gross flipping price results from taking the selling price and subtracting the purchase price. That gross profit does NOT include the cost of labor or materials to fix a house nor any of the other expenses involved with flipping or renovation. Those are the kinds of finer details which do not easily fit into a 30 or 60 minute house flipping show. More on that later.

An investor can make money house flipping in this area IF AND ONLY IF expenses remain in check.

So here is how we do the math and carve out our own niche in this competitive space.

First we must mention some important percentages. In the RealtyTrac article cited above, they discovered that “on average (house flippers) are buying the homes they flip at a 27 percent discount below full market value and selling them at a 6 percent premium above full market value, helping to deliver strong flipping returns on average.” Those percentages, though general, give a good starting point to consider how to really make money house flipping.

Buy low and sell high. The motto of Wall Street is crucial in Real estate as well. The best advice we received early on was “you make your money at the buy”. If you get sloppy, impatient, or greedy when looking to purchase, you are liable to start your reno in the hole. To find a single ounce of gold, miners do the dirty work of moving of tons upon tons of dirt. The same is true of ‘mining’ real estate.

DIG DEEP

Let’s be clear. If you want to make money house flipping, you cannot wait and begin on demo day! It begins while digging through the tons of dirt searching for nuggets. Some of the best profits made come as the direct result of looking through countless house listings, viewing dozens of photos per house, pairing down the possible prospects, looking at comps by walking threw dilapidated house after run down junker. Finally the nugget is visible But wait! Before even thinking of making an offer, there are tons more yards of dirt to sift.

Remember ” you make your money at the buy”. An essential ingredient to making money house flipping requires the flipper or renovator to accuarately understand and become familiar with every flaw in the house. Flaws correctly discovered and identified yield power at the negotiating table. We come ready to paint an enlightening picture of the true condition of the house. This allows the seller to readily see the real costs needed to bring this house back to a more marketable condition.

The job here is not to exaggerate. A good realtor or informed seller can readily snif that out. Instead, our research highlights for the seller how our offer provides a fair answer to their need of achieving a sold sign on this house. Additionally, a thorough inspection enables us to avoid catastrophic ‘surprises’ which can demolish an otherwise profitable venture.

We make an extensive list of all known flaws and potential flaws. At every turn, we assume the property is in worse shape than we can see. This is especially true if the bank won’t disclose details about the house (which they can legally get away with – much to the flippers consternation). With the list of flaws in hand, we attach a price tag to remedy every flaw. At this point, we can finally approach an understanding of a workable offer price.

The meaning of a ‘workable price’ obviously varies. It will depend on location, location, location. Price depends on the housing market – houses selling faster than the arrival of new listings. Or maybe the market becomes saddled by a glut of house inventory. And much also depends on the extent of work needed and the time involved in renovation. A ‘ paint and carpet ‘ renovation screams ‘quick and easy!’ . A house gutted to the studs with new electric and plumbing doesn’t just scream but shrieks as well! That means time, money, and many headaches. But then again a greater risk may bring a greater reward.

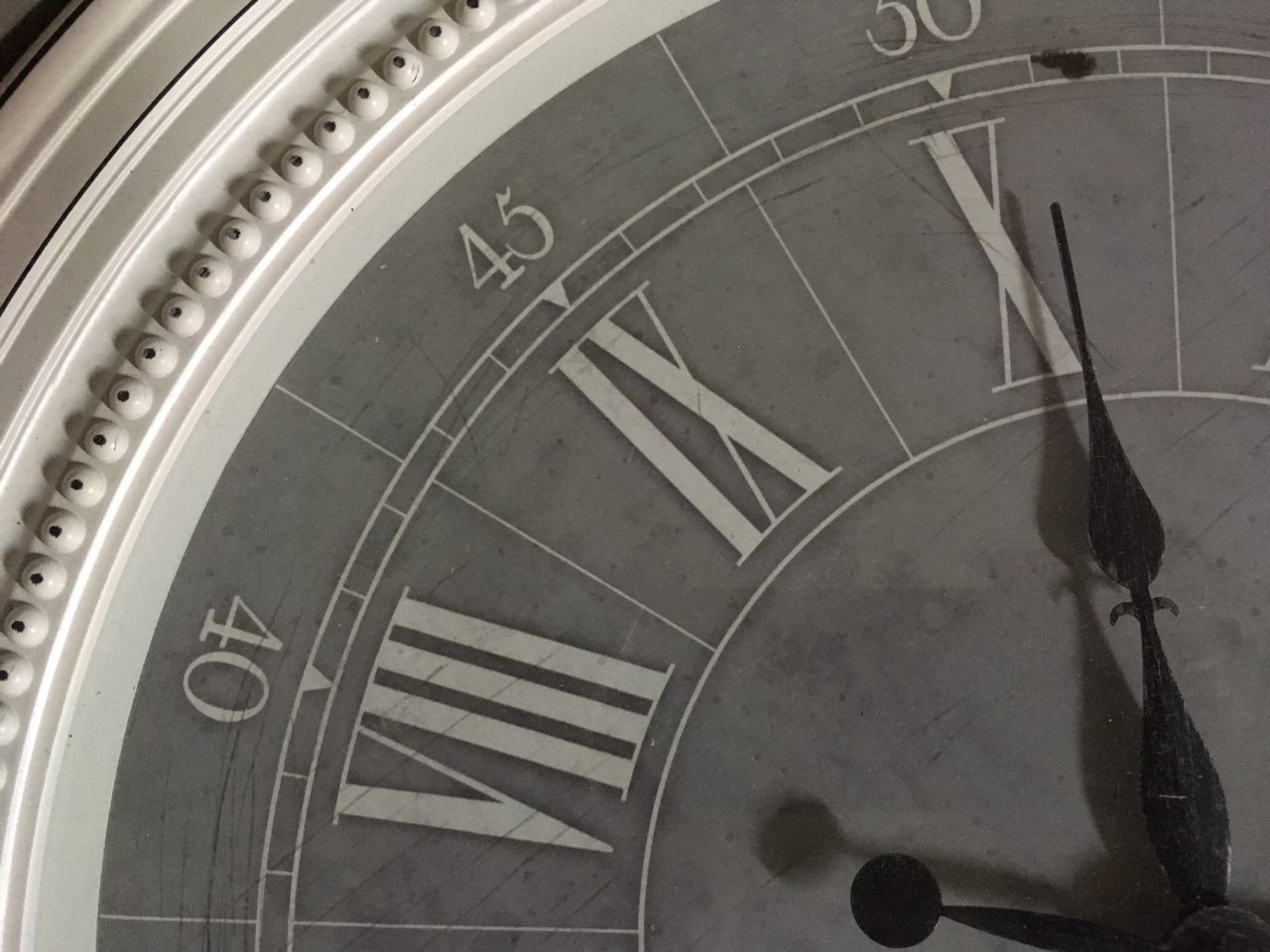

TICK TOCK GOES THE CLOCK

Before going forward, highlight the word ‘TIME”. To make money house flipping, unwavering attention needs to be paid to TIME. Every project takes longer than you ever estimate – PERIOD! And

time costs money. Always factor the interest you must pay on any borrowed money. Pay strict attention to time spent on all parts of the project. We always wrestle between the time it takes us to accomplish a task vs. hiring out the task and speeding the project along. A proper balance requires keeping those concerns at the forefront of your mind.

LOOKING TO BUY. When it comes to real estate, you are looking for the opposite of the consumer mentality. Work hard and sift the dirt thoroughly. Houses sitting on the market for months are gold. The longer they sit, the more open the sellers become to reasonable offers. ‘Ugly’, ‘dated’, and ‘lost in time’ are phrases that don’t really show up in listings, but the pictures don’t lie. When we see hideous pictures, we know we are close.

We buy houses that scare other flippers. If you know flippers, you’ve probably heard that before. But, seriously, our before pictures paint the truth.

That is our niche. And that kind of niche makes the math more inviting. Our general target aims to buy at a 30% discount to average market value and sell ( or value the rehab at completion ) at 10% over average market value. If we can hit those marks, we are well on our way to achieving the goal to make money house flipping.

CHASING THE DISCOUNT

We purchased our very first flip renovation for our new ‘business’ at a 67% discount to the average market value! That’s great math but you have to remember that there wasn’t much left of the house. We started with a house involved involved in a fire. We basically paid for the property value. Nonetheless, we had a lot of wiggle room.

In the House Fire Flip, we added 10% to the existing floor plan square footage and as the renovation finished up, we enjoyed a 20% premium to the market. Rebuilding that house took about 15 months and massive amounts of sweat equity, but that was the plan. We called it our flipping university. Every day of sweat equity was our tuition payment and graduation was our completed house. We learned a ton! And happily, it paid off well!

In contrast, we purchased our Golf Course House flip at only a 20% discount to the market. It was more of a cosmetic renovation though we did add a bit of bling through a master bathroom upgrade. Still, we only achieved an 8.5% premium to the market average at the closing table. The margins were much tighter but the work only lasted 4 months with another 3 months till we closed. After expenses we only made about 15% ROI.

MARGINS MATTER

With such tight margins, we could have easily done that flip for ZERO profit. We experienced a bit of a miracle. We ran into a buyer who didn’t really want a 2-story house but confessed that he absolutely must live on the golf course. Location, location, location was the key ingredient. Lessons learned! With tight margins, everything MUST go right, or we would work for free!

Currently, a Lake House captivates us! Captivating also means – tough to quantify – due to the house’s unique character, design and location. Still, I would estimate that we purchased this at about a 40% discount to the market. A 10% premium at closing would be a minimum. So once again, the wider margins bring wiggle room and breathing room!

THE ANSWER FOR US

From these real life examples, not from the coasts but from the heartland of the country, we can say we indeed make money house flipping. The answer to the title question echos a resounding YES! with a few words of caution. Profit potential exists. But working for weeks or even months with no coins in your pocket at the end daily nags at the mind of any flipper living in reality. There’s no guarantee the you’ll make money house flipping. Likewise, there’s no guarantee you’ll end up in the poorr house. It all depends on how well you dig, how accurately you plan, the quality of your work and design, and finally, which way the scale tips at the end.

BUILD AN ADVANTAGE

So here are six ways to tip the scales in your favor and make money house flipping.

- Location, location, location. If you missed this point, go back and reread the article!

- Quality matters. If you are looking for premium profit, you need quality craftsmanship and desirous finishes.

- Discipline and patience must show up every day. If you want to wing it and crave the impulsive play, then maybe a Vegas slot machine sounds like a better match.

- Have a solid and achievable plan. The plan can change and grow, but planning builds profit.

- Find a real estate friend or partner. Or better yet, go study and become a licensed realtor. It stacks the deck in your favor.

- Don’t overlook time – the time value of money. Time is money. Balance them well.